1. Accounting(Effects on accounting due to negative interest.)

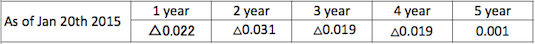

According to the recent interest information announced by the Ministry of Finance as of January 20th, interest rates on short and medium-term Japanese Government Bonds (JGBs) have dropped below zero.

You may imagine some accounting standards, such as Asset Retirement Obligations (ARO), Pension Liabilities, Leases and Impairment will be affected. However, what concerns companies is not just the result, but the process on calculations; should it be treated as minus interest or can be calculated as zero interest? If they have to be evaluated with negative interest rates, it could profoundly affect the workings of IT systems.

There may be an increase in inquiries from companies with a FY ending in March regarding the case of keeping interest rates below zero to the coming fiscal year end.(Souce:“Keiei Zaimu Magazine”No.3197)

2. Taxation (Exit tax on capital gain.)

With the new tax reform of 2015, exit tax, as a part of income tax on capital gain for certain residents in Japan moving abroad, will become effective from July 1st, 2015. At the time of exit from Japan, Japanese residents who satisfy both of the following conditions will be subject to tax on gain on securities calculated at the rate for an individual selling those securities, even though the securities have not been sold. : A) Individuals who hold certain financial assets with a total value of JPY 100Mn or over upon departure from Japan. B) Individuals who have maintained their residence or temporary place in Japan for 5 years or more during the decade prior to their departure from Japan. Not only public securities, but also unlisted securities, stock options and stocks for foreign entities will be subject to exit tax. (Source:“Zeimu Tsushin Magazine” No.3345)

3. Labor Management(Rejection of Formal Employment after Probationary Periods.)

A probationary period is regarded as a certain length of time set by an employer to monitor and evaluate an employee’s eligibility for regular employment. However, employers must be very careful if they decided to refuse regular employment upon completion of a probationary period.

Although the relationship between a probationary employee and an employer is deemed as a state under which a “labor contract exists that upholds the unilateral termination right of the employer,“ the Supreme Court of Japan has judged that the rejection of regular employment upon the completion of a probationary period is deemed to be a termination of a labor contract, namely a dismissal, from a legal standpoint, and is regarded as an abuse of the right of dismissal and is invalid as long as it lacks both objectively reasonable grounds and appropriateness in general societal terms.(Source:The Judgment of the Grand Bench by the Supreme Court of Japan dated December 12, 1973.)

4. This Week’s Words of Wisdom(Source: 100 words in the world.)

Don’ be sitting on the fence. Don’t be a spectator.

Being involved is the key for any business.

(Den Fujita, the founder of McDonald’s Japan)

You may have heard that Den Fujita became a notorious maverick after World War 2 by setting up McDonald’s Japan and dulling the keen Japanese sense of taste. But he was an entirely active person. Sad to say the world in general seems to be full of spectators nowadays.

The referring page is Nagamine & Mishima JC Accounting K.K.